Retirement Plans/IRA

Consider naming the Federation as a remainder beneficiary of your IRA, 401(k), 403(b) or other qualified retirement plan.

If you would like to make a significant gift to the Federation and you anticipate that your retirement plan has assets beyond what you will need during your lifetime, please consider naming the Federation as a remainder beneficiary of your IRA, 401(k), 403(b) or other qualified retirement plan.

Retirement plan proceeds paid after death are subject to both income and estate taxes. Because of this double taxation, possibly as high as 75% or more, these are not ideal assets to leave to your heirs. Instead, it would be more beneficial to leave other less heavily taxed assets to family members and use your retirement assets to provide for the charitable causes you care about (the proceeds from your retirement plan will pass to the Federation tax-free).

Options:

- Your retirement plan designation may be unrestricted in order to provide for our general operating costs.

- You may restrict your retirement plan designation to a particular fund or purpose, either by establishing a new fund in your name or by adding to an existing one.

- Or, you may use the remainder of your IRA or other retirement plan assets to fund a testamentary charitable remainder trust for the benefit of family members after your lifetime.

Advantages:

- Simplicity. Simply fill out the change of beneficiary form provided by your plan administrator and designate the Jewish Community Federation and Endowment Fund as a beneficiary.

- You may name the Federation as a contingent beneficiary of your retirement plan, in which case the Federation will receive your retirement plan assets only after your spouse (or other designated primary beneficiary) has passed away.

- You will reduce your estate taxes and your heirs will avoid having to pay income tax on the retirement assets they receive.

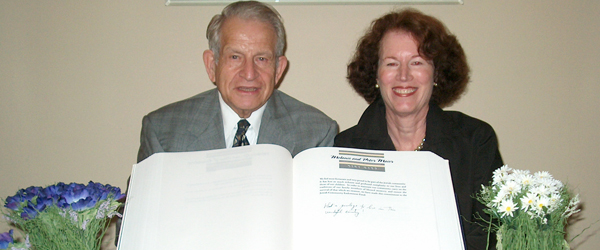

By naming the Jewish Community Federation and Endowment Fund as the remainder beneficiary of your retirement plan, you will become a Living Legacy Society member, our recognition society for those who have had the foresight and generosity to include us in their estate plans. You will also be invited to contribute to the Book of Life, which contains personal accounts of why our supporters have chosen to make the Jewish community part of their legacy.

If you are aged 70 ½ or older, you may donate up to $100,000 in a given year directly from your IRA to the Federation. The distribution will be tax-free and will count toward your required minimum distribution (RMD). Your plan administrator or our planned giving office may assist you with the necessary simple steps.